Prior to purchasing life insurance, you should always view quotes from multiple providers. We can compare life insurance quotes right here so that you can see how different death benefits, lengths of coverage, and different companies stack up by price. You will see that for each specific person and situation, a different company may be less expensive than another. There is no “one cheapest” company out there. You must use our quoting widget to compare companies based upon your age, sex, and desired structure of the life insurance policy.

What Is a Life Insurance Quote?

A life insurance quote is an estimate of what the price of insurance will be. A quote gives the estimated premium, which is the amount of money that needs to be paid into the policy each year. A life insurance quote can be a bit more complicated than a simple price because the price of life insurance can change each year. A true quote will show the cost of insurance in every single year of the policy so that the policy owner can make intelligent decisions about whether or not owning the policy fits into their finances over time. It can be wise to compare quotes from multiple companies in order to find the best-priced policy for your specific needs.

A quote is an estimate because the price of the insurance depends upon the health of the insured person. A healthier person will get a lower rate, and a less healthy person may get a higher rate. Insured people are classified into different groups by the insurance company, each group being given a specific health rating. It is impossible to know which health rating a life insurance company will ultimately assign you without going through their underwriting process. Please note that a quote is not a guarantee that the insurance will not cost more.

How to get a Term Life Insurance Quote

You can get a quote on life insurance easily in a matter of minutes. Use either our quoting widget or enter your zip code above. You can also call us at 1-844-578-0620 and speak to someone over the phone to get help with life insurance quotes. You can easily get a price estimate by providing your age, sex, state of residence, the death benefit desired, the length of term coverage, and your estimated health. If you are healthy you will get a better-priced quote, if you are unhealthy or a smoker, the quote will be for a higher premium amount. The widget only takes a minute, but for more accurate quotes you should fill in the complete form. Here is our widget that you can use for a quick quote.

Basics of the Price of Life Insurance

The price of life insurance is ultimately affected by the amount of life insurance purchased (the face amount), the type of life insurance purchased, the age and health of the insured person, and the length of coverage needed. These many factors can make getting an accurate quote difficult for many people when they don’t get any guidance. It can really help to work with an expert in order to understand how each of these variables affects the price and to make sure that you understand what the quote is saying.

One of the most important pieces to understand is how different types of life insurance have very different prices. Whole life and term life are the two most common types, and both types are very different products. Term life tends to be much less expensive than whole life on an annual basis, but the coverage expires. Whole life is meant to last the entire life of the insured person, and in addition has a cash value account that can be tapped by the owner for money, even while the insured person is alive.

Within each type of life insurance, the policy can be structured differently and this can also have a large effect on price. For instance, a term policy can be purchased for a 10-year coverage window, up to a 40-year coverage window. The longer the coverage, the more the insurance costs per year. Whole life policies can pay dividends, which can be used to offset premiums.

So when you are getting a quote make sure that you understand the product that you are looking at, the amount of coverage that you need, and how health can affect the price.

Basics of A Life Insurance Quote

This is the information that you will need to obtain the most accurate quote, and how to read the quote once you get it.

What You Need For a Quote

A quote is relatively simple to obtain. The information that you will be asked to provide includes:

- Your name

- What part of the country you live in

- Your age

- Your gender

- The amount of life insurance coverage that you need

- An estimate of your overall health condition

- The type of life insurance that you wish to purchase, and the length of coverage if you are considering purchasing term life insurance.

It takes on a couple of minutes to fill in the form to receive a quote. You do not need to provide any sensitive information such as your social security number or your exact address. You can compare prices from different major providers, and choose to contact a specific provider if you wish. An expert can also help walk you through the form and give more detailed information about the policy that you are being quoted. Because life insurance can be complex and has a lot of features that can be customized, working with a licensed expert can be highly beneficial.

What Does a Quote Look Like?

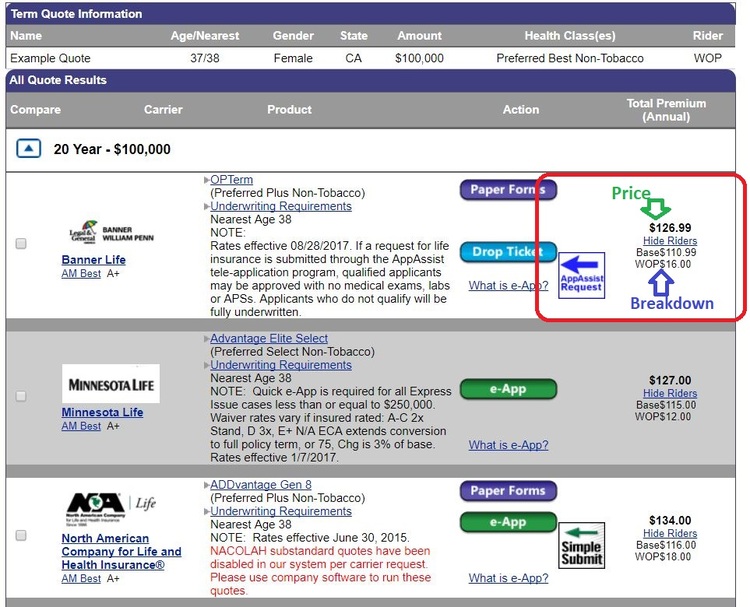

Here is an example of a quote comparison:

The insurance company is on the left; the middle shows the health rating, the insurance age, and some notes regarding either the company, the quote, or the application. On the right, you can see the price. This example quote is for a 38-year-old woman with a good health rating, and the policy has a waiver of premium rider. The cost and breakdown are all included, and any riders can be added or deleted depending upon preference.

As you can see the quote comparison tool makes it easy to see the best price, and compare prices across companies. Note that financial ratings are important to consider, but most states also provide a guarantee to step in and payout claims if the company fails, up to a certain dollar amount. It is always safer to choose insurance companies who have been in the business for a long time and maintain a strong financial rating.

The Least Expensive Company is Different for Everyone

Life insurance costs can vary significantly from company to company, and from product to product. This is precisely why it is so important to comparison shop.

Life insurance companies price each policy depending upon a person’s age, gender, and health history. By dividing people into different risk classes, life insurance companies separate people based upon the odds of paying out a claim. Because underwriting guidelines are slightly different at each company, the risk class that each company assigns you to may differ. This means that while for one person, New York Life might be able to provide the least expensive policy, for another customer, MetLife might have the best deal. Only by comparing quotes for each person will you be able to unearth the best policy to fit your needs, exact situation, and price. In today’s modern age, it is so easy to compare quotes online that every person should do it before purchasing a policy.

Why You Should Compare Quotes

It is important to compare quotes from different companies even if you are working with a financial advisor or life insurance agent. Most people compare quotes to find the least expensive policy available for the amount of coverage that they need. Some agents are required to sell insurance only from the company where they work. Others are able to look at many companies. It can be helpful to shop for yourself either way. When you compare prices for yourself, you get a feel for the market, and you can be assured that you are getting a policy for an appropriate amount. You may also find a policy that costs much less than one an agent is making available to you. When it comes to insurance prices, knowledge is power.

Agents are typically incentivized to push the highest margin products on their clients, or at the very least products from certain companies over other companies. A neutral provider of quotes only wants what is best for the client.

Tips For Getting The Most Accurate Quote

- Give accurate information. Prices can vary between locations, genders, and ages. Sometimes the prices can vary significantly. If you do not provide accurate personal details, your quote will not be very accurate either. Life Ant does not use your information except to provide quotes.

- Be honest and conservative regarding your health. The health rating that you ultimately receive will play a big part in how your policy is priced. If you have health issues such as high cholesterol, high blood pressure, or if you are overweight, do not assume that you will receive the best health rating. It is better to be conservative when you get a quote and have your policy ultimately cost less than the amount that was quoted to you. Remember that underwriting will decide your final rating.

How to Get a Quote on Whole Life Insurance

To get a whole life insurance quote you can enter your information into the form and indicate that you are interested in a whole life insurance policy. An expert will reach out to you to help you customize your policy and understand the different options available to you.

Whole life insurance is significantly more complex than term life insurance and it is highly difficult for a non-expert to understand a whole life insurance quote without help. Whole life insurance pays dividends, which can be used to offset premiums. Eventually, the dividend may become larger than the annual premium due, and no more money needs to be put into the policy. Dividends can also be used to purchase more paid-up whole life insurance, which increases the death benefit and increases future dividends. Dividends also are not guaranteed and can change over time. If no dividend is paid you still need to be able to afford your entire premium payments over time.

The Many Uses of Whole Life Insurance

Whole life insurance is sometimes necessary even though it can cost more money. Some uses for whole life include:

- Guaranteeing that coverage will not expire.

- A conservative investment product with tax advantages.

- Funding a trust.

- Avoiding estate taxes.

- Facilitating a fair division of an estate with large non-liquid assets such as a second home or valuable artwork.

A Whole Life Quote is Called an Illustration

A whole life insurance quote has a lot more information than a term life insurance quote. Besides showing a “price”, it shows how the cash value of the policy and dividends are expected to grow over time. The cash value can be accessed for withdrawals, and dividends generally grow over time. Prevailing interest rates and the profitability of the life insurance company can affect the amount paid out in dividends. Because the numbers change over time, an illustration shows a year by year breakdown of the projections.

Make sure that your whole life illustration shows you both the projected dividend payments and cash values, in addition to the minimum dividend payments and benefits. The minimum illustrated reflects a “worst-case scenario” for your policy. It is unlikely that your policy will perform at the minimum, but it cannot legally perform worse. Make sure you understand it entirely because it can be a little complex for people who aren’t used to seeing an illustration, but it is relatively easy to understand after it is explained.

Tips For Saving Money on Life Insurance

Nobody wants to spend more on insurance than they have to. Life Ant was created to save you money by comparing quotes. Here are the best ways that you can save money on your life insurance beyond comparing quotes.

- Buy what you need. Remember, the more life insurance coverage you need, the more it will cost. While it is better to have a little too much life insurance rather than too little, paying for unneeded coverage is a waste. For help determining how much coverage you need, you can use our needs calculator or speak with an advisor.

- Shed extra pounds. Not only is it unhealthy to have excess body fat, but it increases your odds of receiving a lower health rating from underwriting. Life insurance costs less when you are a healthy weight.

- Take Prescribed Medicine. Most people have some minor health issues. You can still get very affordable life insurance even if you have high blood pressure or cholesterol. The most important thing that underwriters will be looking for is that any issues are well controlled with medication.

- Do Not Try to Manipulate the Quote. Regardless of what you put in for your information on the quote form, the life insurance policy will perform reasonable due diligence and underwriting on you. This may include obtaining your medical records, having you fill in your information on an official questionnaire, and performing a life insurance paramedical exam. You can not “put one by” the insurance companies, and if you do and you pass away, and the insurance company investigates (they all have departments dedicated to this), and it turns out that you were hiding information or were not truthful, your claim may be rejected. Honesty is always the best policy. Get a realistic quote based on where you think the state of your current health is. If you have questions about this, you can always ask our experts for advice by giving us a call.

Universal Life Insurance Quotes

Generally, these policies are more difficult to quote than either a term or a whole life insurance policy. Universal life insurance has a flexible premium payment schedule. The cash value account pays interest, and the cost of insurance rises over time. For these reasons, we request that you give us a call and work with an agent who is an expert in designing the policy.

Generally, universal life policies work best when they are well funded, meaning you have a lot of cash to put into the policy. Ultimately the policy performance in terms of cash value growth will be significantly affected by your ability to fund it, or even “overfund” it.

We also warn clients that a universal life policy can become extremely expensive in the later years. Unless you are very comfortable that you understand the risks and possible benefits of this policy type, we will generally warn our clients not to buy this type of life insurance policy. If it not structured correctly, funded appropriately, and even surrendered at the correct time, a client can end up spending a lot more money for the same amount of coverage that they could get with whole life or term insurance.

Universal life policies also have a higher rate of return when interest rates are higher. In a low-interest-rate environment, a client may be better served from a rate of return standpoint with a properly structured whole life insurance policy.

If you are still interested in learning more about a universal life insurance policy, please contact us, and we will be happy to work with you to provide an education and to inform you during your buying process.

What About Variable Life Insurance Quotes?

Variable life insurance is another form of cash value life insurance. Instead of earning interest from the insurance companies’ general account, or a calculated rate associated with LIBOR, the value of the cash value in a variable life insurance policy is related to the performance of equity markets. There a lot of different forms that a variable policy can take, but a frequent iteration is a variable universal life policy.

These policies generally give the owner the ability to choose from a basket of mutual fund-like offerings comprised of different segments of the equity and bond markets. Without getting into too much detail, a variable universal life policy (also known as a VUL policy) has a flexible funding scheme like any universal life policy does. Furthermore, because the cash value is tied to the performance of the stock market and the individual investments chosen by the owner, the rate of return is virtually impossible to predict. This makes accurate quoting extremely difficult.

There is one aspect of a VUL policy that can be very accurately quoted, however, and that is the actual cost of insurance in each policy year. This is the most important aspect of the VUL to keep in mind.

Many policies also have various riders that either guarantee a minimum policy performance if certain conditions are met or provide additional benefits beyond simple life insurance coverage. This makes it a nightmare for a regular person to try to generate their own quote and illustration.

If you are shopping for a variable life policy, our expert agents will be happy to help. Contact us and let us know what you’re looking for and we can recommend products and explain every feature to you so that you are confident that you know exactly what you are buying.

Why You Need Life Insurance

Life insurance is a subject that many people do not feel comfortable discussing. While it reminds us of our mortality, we all should provide for our family and loved ones after we have passed. This is doubly true in the event of an untimely passing. Life insurance is all about being prepared for the unexpected. Life insurance gives you the power to ensure your family’s prosperity after you are gone.

Uses of Life Insurance

Life insurance serves many purposes. You may be surprised to know all the reasons that people buy life insurance:

Life insurance serves many purposes. You may be surprised to know all the reasons that people buy life insurance:

- Life insurance can provide living expenses for a spouse, children, or family.

- Life insurance can preserve or provide a retirement for a spouse living partner.

- It can give a grieving family some respite from expenses during the time immediately after death, when they may miss work and have extra costs.

- Life insurance can facilitate the passing of estate assets on to beneficiaries by paying any estate taxes that may be due.

- Whole life insurance serves as an investment tool by accumulating cash value and providing a return on capital through dividend payments.

- A life insurance policy can also provide a legacy to your family, even ensuring money is available to your descendants for many years to come. Many wealthy individuals fund trust accounts with life insurance.

- Life insurance is used for business purposes. Sometimes it may facilitate a buy out in what is known as a buy-sell agreement, or it may compensate ownership for the financial detriment to the company from losing key people.

Important Basics Of How Life Insurance Works

If you are unfamiliar with life insurance, life insurance is a contractual agreement between a natural person and an insurance company. The agreement provides that in return for timely premium payments to the insurance company, the company will give a specified death benefit upon the death of an insured.

The death benefit is paid tax-free to the named beneficiaries, and the contract owner determines the beneficiaries. To buy a life insurance policy on someone else’s life, you must have an “insurable interest” in that person. Having an insurable interest means that if the person passed away, it would have a negative financial impact on your life. Direct family members are assumed always to have an insurable interest in each other. Other examples might include a business partner, an employee, an employer, or anyone who would cause a financial loss to you if they lost their life. No one wants people gambling on lives with insurance policies. Also, don’t worry, no one can take out an insurance policy on you without your knowledge!

About The Different Types Of Life Insurance

There are different forms of life insurance, such as Term, Whole Life, Universal Life, and Variable Universal Life Insurance. Each product has various features and costs, and each may have slightly different uses. Regardless of the nuances of each, every product type shares the purpose of providing for loved ones, or even a charity, after an insured passes away.

Every type of life insurance has a cash value component except for term life insurance, but term life is the most common type of policy written. Keep in mind that the expected cash value of a life insurance policy is a vital part of the quote. Make sure that you understand what your cash value minimum and expected amounts will be at different years of your policy, and make sure you know the rules for accessing this money through either a loan, withdrawals, or surrenders. An adequately made illustration can give you all the details even if you are planning to take cash from your policy. Make sure you share this with your agent when you are doing your research.

What to do if After You Get a Quote, You Want to Buy a Policy

We are happy to assist you and hope to call you a client for life. Unfortunately, current laws don’t allow for the purchasing process to be done entirely online, but it can be completed over the phone. Here is what will happen after you decide to move forward.

- An agent will call you or reach out by email. They will confirm what you want to purchase, and that it makes sense for you given your income and financial situation (laws prevent consumers from buying way too much insurance given their income to both protect the consumer and to avoid money laundering).

- The agent will send you an application. You will need to fill it out and sign it, and the agent will need to do the same. They may pre-fill many of the questions by asking them to you over the phone and sending the app to you for signatures only. Unfortunately, there are usually many places that you need to sign and initial, so make sure that you get each spot signed to prevent delays in processing at the insurance company.

- Depending upon the amount of coverage you want and your age, you may be required to schedule a health exam. A paramedical nurse will come to your house or apartment and perform the exam. It usually takes less than 20 minutes and is fairly simple. It can include testing your blood pressure, collecting a blood sample or a urine sample, testing your heart rate, and weighing and measuring you. Don’t stress about the exam, it is simple, and the trained nurse has likely performed hundreds of them.

- The application and results of your health exam and or medical records are all submitted to the insurance company. An underwriter studies them and decides whether to approve your application or not. They may place you in one of many risk classes depending upon your overall health such as “premier,” “premier plus,” “standard,” or “substandard.” The risk group that you are classified in will determine the price of the policy, so it does matter.

- Your policy is delivered after approval. You will receive an actual copy of the contract, which you should keep very carefully for your records. The agent will collect the annual or monthly premium due and explain how you should pay the insurance company in the future. You are now covered!

The Most Important Thing is To Understand What you Purchase

Life insurance can be complicated, but with a little research and explanation, it can be easy to understand. The most important thing is to understand what you need, to understand how much is a fair price, and to understand how the product works once you own it. Please use our educational resources to learn about life insurance. Please also feel free to contact us with any questions.