Gathering every revealing bank statement and financial document to your name, sitting down at a table with a guy in a suit, smiling politely while he talks about stuff you don’t understand and tells you how to invest your money and what insurance to buy, these are the signs that you are going through the time-honored tradition of meeting with a financial advisor for the first time. If millennials have anything to say about it, this tradition may meet a swift end. According to a survey by us at Life Ant, about 70% of millennials will look to buy life insurance online rather than through a life insurance agent.

Millennials are Getting Older

Millennials are getting older and more established. The oldest among them are getting better jobs and starting families, they are making more money, and they are starting to make up a bigger percentage of the workforce. According to our survey, they will soon start transforming the life insurance industry.

We know that millennials prefer to buy things online. Services that cater to the younger generations like Amazon can do everything from deliver electronics to groceries right to your door, and apps like Seamless and Uber have profoundly changed food service and transportation in every major city. Looking for more informative and more efficient ways to get stuff done online is what millennials do.

Well, it should come as no surprise that millennials also overwhelmingly prefer to buy life insurance online, rather than through traditional means such as a financial advisor or life insurance agent. Because they prefer to buy insurance online, millennials will no doubt change the life insurance industry just like they have revolutionized many other industries. In some ways, it is far overdue for an industry little changed in decades.

Survey Results- Millennials Say Yes To Online Life Insurance

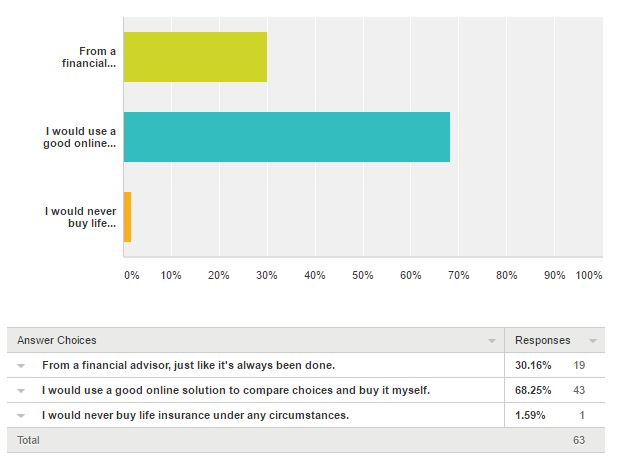

We surveyed 98 people through a random online survey. The results were overwhelming and unequivocal. 63 of our participants were between the ages of 18 and 39, and nearly 70% of these millennial participants said they will look to buy life insurance online before they meet with a financial advisor.

This compares with those 40 and older, of which 60% said they would prefer to go to a financial advisor for a future life insurance purchase over an online source.

How This Will Change the Industry

The results of this survey are clear. Millennials are now starting to have families and have a bigger need for life insurance, and the older generations will age beyond buying much life insurance. As this happens, the supply of clients for life insurance agents will dwindle, and the supply of clients looking to buy life insurance online will increase significantly. This could mean that the future of life insurance agents is not bright unless they adapt.

A Possible Reason

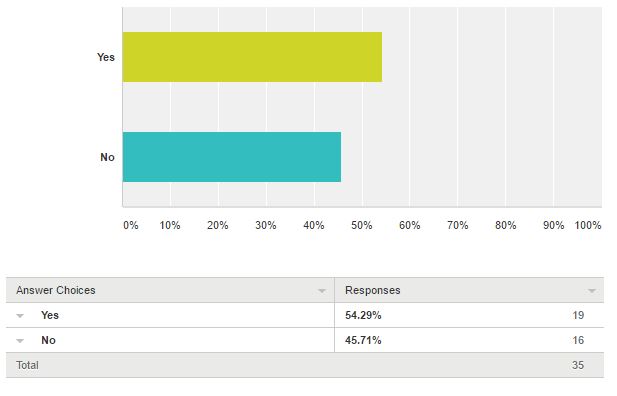

Also asked in our survey was if respondents think that existing available resources are sufficient for them to judge their life insurance need and make a purchase online without the help of an insurance agent or financial advisor. There was a pretty large disparity between the age groups here as well. Here are the results from our 40 and over group.

It is almost a 50/50 split between those people who trust the existing online resources and those who don’t. Clearly the older generations do not trust that what is currently available to them online can meet their needs for choosing a life insurance policy.

Maybe this is an opportunity for websites such as Life Ant to improve what we offer so that even these older generations feel that we can meet their needs, or maybe we need to market what we already offer to them more effectively.

The younger Millennial generation has much more trust in current online resources. 68% of them feel like they would trust an online marketplace like Life Ant to help them find an appropriate policy.

Conclusion

The life insurance industry needs to prepare itself for these changes. Companies that rely solely on a giant archaic network of agents may see steep declines in business over the next decade, and companies in a position to capitalize on online sales will be rewarded. Life insurance agents need to prepare for the change because the old way of doing business will not last.

Consumers will be better off because they will be able to compare options themselves and choose the best option and the least expensive policy, and they will be better informed because they will need to shop for themselves.

Companies offering life insurance policies online will need to be careful that they provide enough educational material. They need enough high quality needs calculators and other informative resources so customers know that they are buying the right policy for their personal situations.

We work hard to do that at Life Ant and hopefully we succeed. If online companies fail in this regard, life insurance agents will have a lot of business for a long time.